VERIFY THE VALIDITY OF A COMPANY VAT NUMBER

A VAT number or Tax Identification Number (TIN) is a unique identifier for companies, individuals and entities within the European Union's Value Added Taxation scheme.

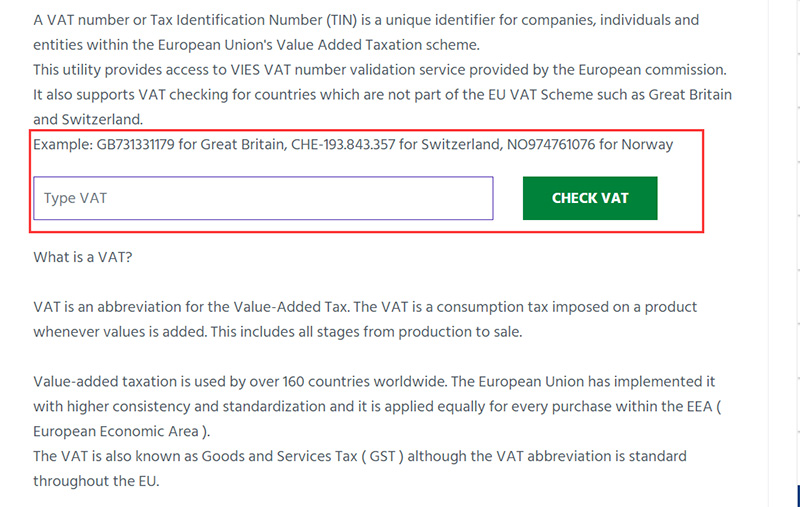

Great Britain and Switzerland.are not part of the EU VAT SchemeExample: GB731331179 for Great Britain, CHE-193.843.357 for Switzerland, NO974761076 for Norway.

What is a VAT?

VAT is an abbreviation for the Value-Added Tax. The VAT is a consumption tax imposed on a product whenever values is added. This includes all stages from production to sale.

Value-added taxation is used by over 160 countries worldwide. The European Union has implemented it with higher consistency and standardization and it is applied equally for every purchase within the EEA ( European Economic Area ).

The VAT is also known as Goods and Services Tax ( GST ) although the VAT abbreviation is standard throughout the EU.

So how to verify the authenticity? ? ?

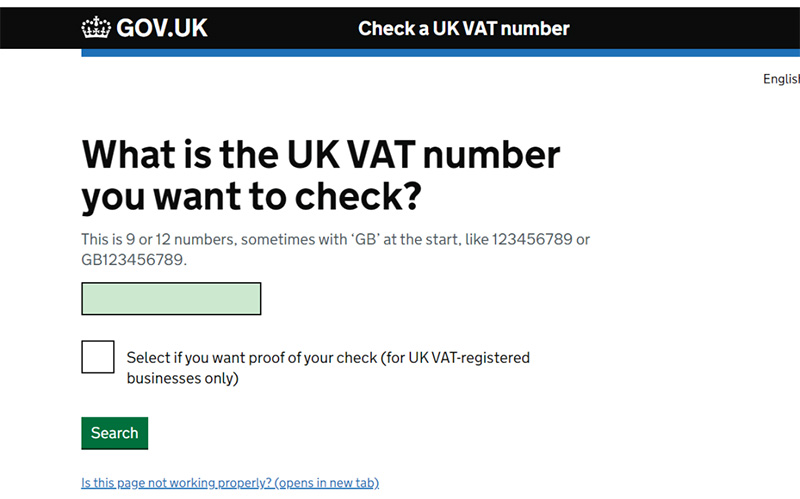

1.Verify the UK’s

https://www.tax.service.gov.uk/check-vat-number/enter-vat-details

Just enter it here, remember to add GB before the number.

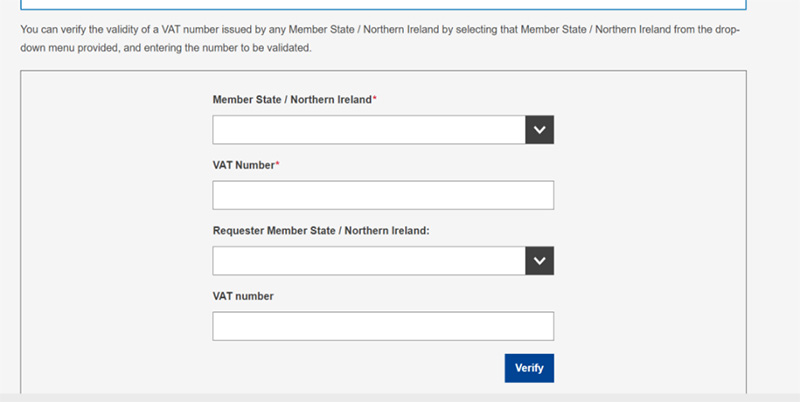

2.For other EU countries, use this URL

https://ec.europa.eu/taxation_customs/vies/#/vat-validation

You can verify the validity of a VAT number issued by any Member State / Northern Ireland by selecting that Member State / Northern Ireland from the drop-down menu provided, and entering the number to be validated.

Because the UK has already left the EU, it is no longer available from the EU website.

3.If you think the above two methods are more troublesome, then use this URL,

https://www.iban.com/vat-checker

But be sure to remember that the country abbreviation needs to be added in front of the VAT number code,

Such as GBXXXX, such as HUXXXX, otherwise it will not be found out.